Blockchain: What It Is and How It Works

You have probably by now heard the term “blockchain,” either in reference to a cryptocurrency like Bitcoin or in relation to emerging technologies that somehow use the blockchain in one way or another. If you’re like most people, you don’t really know what all that means; “the blockchain” is an abstract idea that doesn’t immediately lend itself to concrete definitions.

Without blockchain, digital currencies wouldn’t exist. Blockchain technology has been applied in surprising, innovative ways around the world, and understanding what it is and how it’s used is likely to come in handy, especially if you plan on using or possibly investing in various cryptocurrencies or blockchain start-ups. Even if you have an understanding of blockchain technology, make sure to read through this article as you might learn a couple of things you didn’t already know, as this ground-breaking and novel application of computational concepts promises to continue to lend itself to new applications.

The History of Blockchain

It would be helpful to understand the history of the blockchain and its first theoretical beginnings as a computer science concept that was intended for use primarily with cryptography and encoded data. In the very beginning, one of the early forms of blockchain was something called the hash tree, or Merkle Tree, after its creator Ralph Merkle, who patented the concept back in 1979.

The function of the hash tree was to verify the validity and integrity of data as it was transferred back and forth between computer systems. In some of the earliest examples of peer-to-peer networks, making sure that data being handled by more than one physical machine remained intact—unaltered and uncorrupted—was very important.

Without being able to ascertain the structural validity of networked data, the power of peer-to-peer networking, and the ability to use multiple machines to handle and analyze extensive collections of data would have been out of reach. To ensure that data wasn’t being corrupted as it “changed hands” in the computer network was critically important, and that was the function of the hash tree: to prove and protect the integrity of data shared between numerous physical devices.

Merkle and other computer scientists continued work on the hash tree concept, and in the early ’90s, using hash tree technology, Stuart Haber and W. Scott Stornetta explored the idea of “secure chains of blocks” as a method of creating persistent document timestamps—a series of records made up of data that were interconnected.

Each record would rely on the one before it for proof of validity. The newest “block” of data in the chain would contain the history of the entire chain that had preceded it—and this was the very first working blockchain. It would be impossible for data in a blockchain to become corrupt—or to be altered or faked—since it could be checked by comparing its digital signature to each block that had come before.

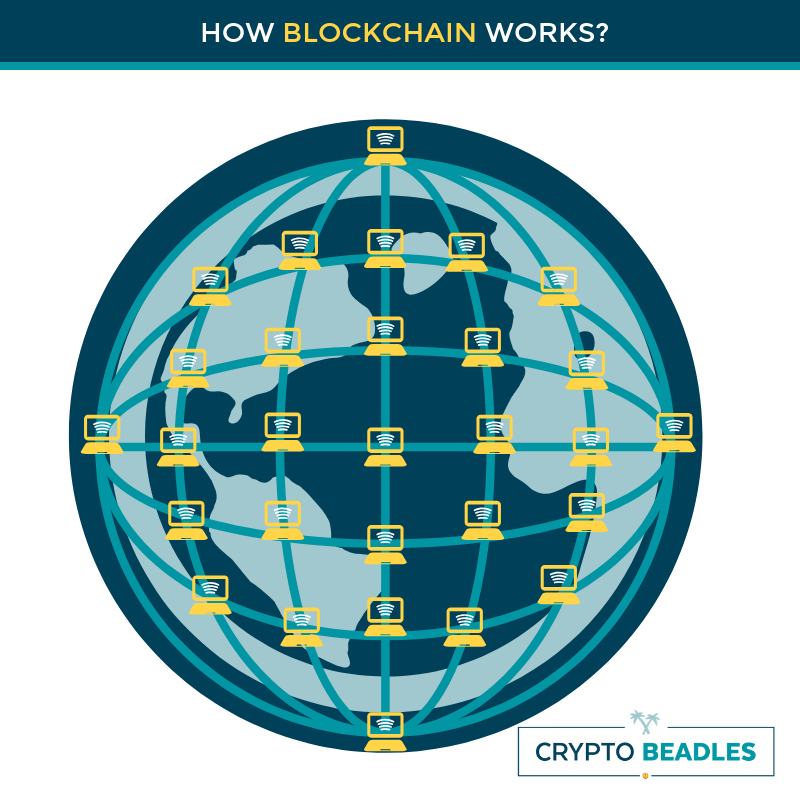

Fast forward to 2008. A mysterious person—or group of people—using the name Satoshi Nakamoto first developed the concept of a distributed blockchain. This distributed blockchain would contain a secure and unchangeable history of every exchange of data that the blockchain was used for, and would rely on a decentralized, peer-to-peer network of computers to timestamp and verify each transaction. The distributed blockchain could be managed autonomously, without relying on any one central authority for validity.

This distributed blockchain became the central critical feature of Bitcoin; without the blockchain, Bitcoin could not be accurately accounted for. Not only was Nakamoto’s distributed blockchain central to the creation and use of Bitcoin, but critical to the implementation and use of all cryptocurrencies. This is the modern Bitcoin blockchain as we know it today.

How Does Blockchain Work?

It’s important to keep a few main concepts in mind when trying to understand how the blockchain functions. First, know that the blockchain holds a record of all data exchanges, referred to as a “ledger” in cryptocurrency circles. The ledger is made up of each data exchange, or transaction. Once a transaction has been verified and validated against the existing ledger, it is added to the ledger as a new block.

The blockchain is, in other words, a continually evolving record, or ledger, of exchanges—transactions—made up of separate entries, or blocks.

The blockchain relies on a distributed system of computing devices to maintain this record and to verify each transaction. When a device “taps into” the blockchain for any reason, it must first download the most recent section of the blockchain and compare it to already existing examples of the same blockchain on other computers via peer-to-peer networking. This way, each node that has access to the blockchain can verify each transaction by comparing it to the copy of the blockchain record that it had, in turn, previously received from another node.

Once a new transaction is compared to the blockchain and verified, it is “signed,” or committed to the record of transactions, and is added to the existing blockchain as a new block. As such, it can never be altered; any such attempt would result in a version of a blockchain which would be rejected as corrupt when compared to the data already contained in previous blockchain transactions. The ledger, in other words, cannot be fooled, as numerous copies of it exist and are being simultaneously created on many other networked devices.

How Does Cryptocurrency Use Blockchain?

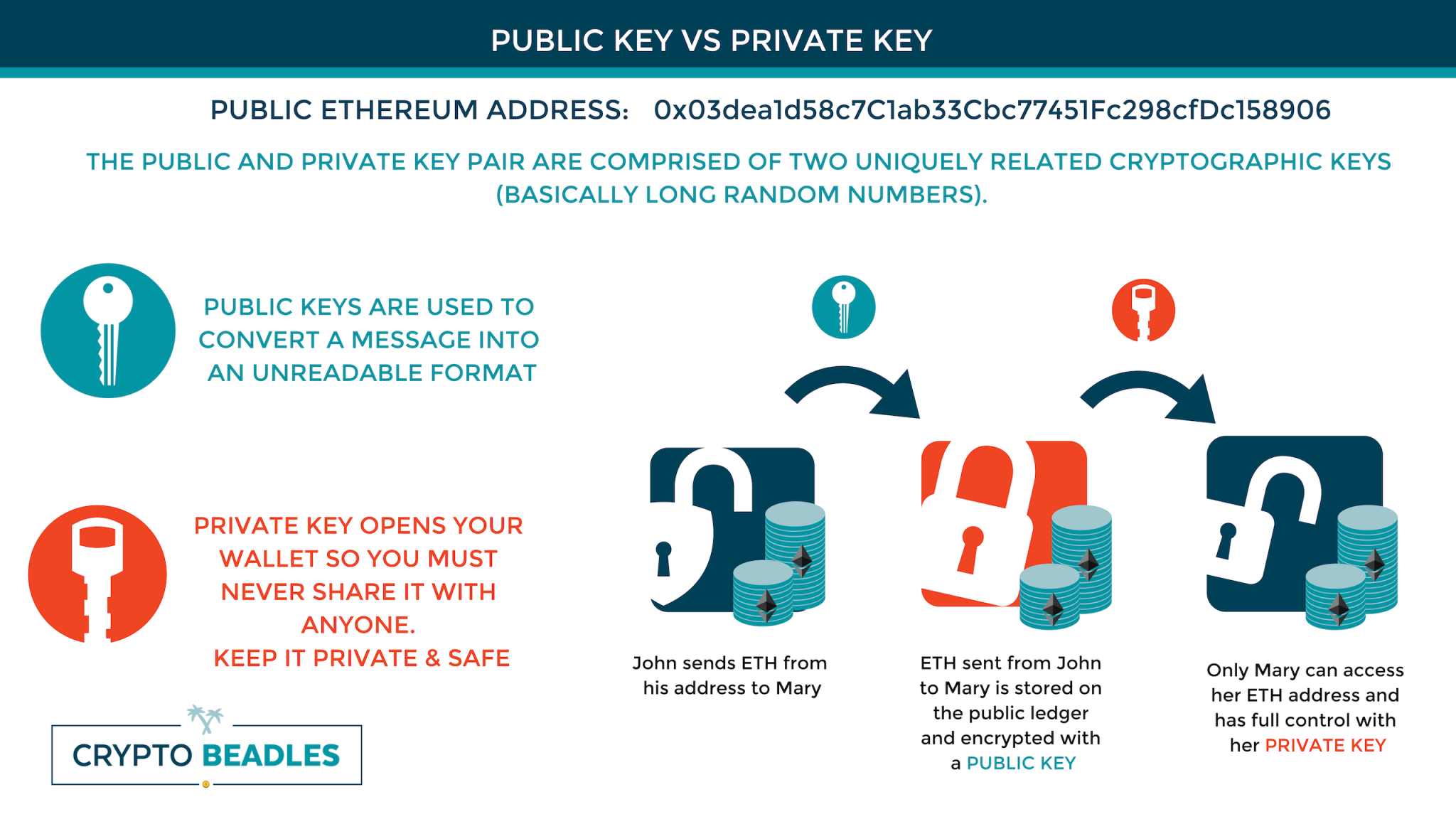

So how does this peer-to-peer, distributed network know whom to trust with copies of the blockchain? This occurs through the use of “keys.” A key is a cryptographic device—essentially a code—which determines a unique identity for whoever uses the key. There are, in fact, a pair of keys—a public key and a private key that, when combined, create a unique digital signature. The public key is the identifying structure in blockchain transactions—it’s how other nodes on the peer-to-peer network identify you, and through this process of identifications know which bits of the blockchain you already hold and which (new) parts may need to be sent to you to keep the integrity of the blockchain intact.

Identical copies of the blockchain thus exist on every single node that accesses it at one time or another. If one device is disconnected from the blockchain for any period of time, all of the other connected devices keep adding transactions to the ledger and maintain the integrity of the blockchain. When a device reconnects, it receives new pieces of the blockchain in order to keep its individual copy of it correct and up-to-date.

For the purposes of sending and receiving cryptocurrency, your public key represents the address of your wallet—the place which holds the record of how many Bitcoin (or other cryptocurrencies) you currently have, and the address where transfers originate from or are sent to. These transfers are made possible by the other key that makes up the pair—the private key. This private key allows you to digitally sign and therefore authorize various actions, like sending cryptocurrency to another public key (or wallet) address.

It’s important to note that an individual’s private key should be seen as a valuable asset worth protecting and keeping secret. If anyone else were to somehow gain access to your private key, they would be able to access any of the digital assets (in the form of cryptocurrency) associated with the private key, and it would allow them to send those assets to any other wallet.

Putting the Pieces Together

Let’s look at a hypothetical transaction on the blockchain. Suppose Ralph is sending Satoshi one Bitcoin. Ralph would use a software interface (of which there are many) to specify Satoshi’s public key—or wallet address—and the amount of Bitcoin being sent. Ralph would then “sign” the transaction by validating it with the combination of his private key and public key.

In effect, Ralph would be declaring to the blockchain network a statement like “I, Ralph, as identified by my private key, am sending one Bitcoin from my wallet, as identified by my public key, to Satoshi, whose wallet is identified by his public key.”

The digital version of that statement—Ralph sends one Bitcoin to Satoshi—would be time-stamped with the exact time of transmission, and assigned a unique identification number. This is what makes up a transaction. That transaction would be broadcast to every node on the peer-to-peer network using that blockchain, which would make a note of it, add it to the ledger, and forever record it in the ever-changing blockchain data.

Every transaction that uses the blockchain contains all of the above: a unique ID, a timestamp, a destination as represented by a public key, and a unique signature that was generated by combining the public key of the wallet sending the transaction with the private key that designated the owner of that wallet.

Furthermore, every transaction is connected—chained—to the transactions that come before it. Anyone who knew the public key address of either Ralph or Satoshi could search through the blockchain for it, and see that one Bitcoin transaction at any point in the future.

So, Is It Truly Anonymous?

A lot has been made of the “anonymous” nature of blockchain trading. The idea of anonymity comes from the fact that your public key is a random sequence of alphanumeric characters—so the blockchain doesn’t record “Ralph” and “Satoshi,” but rather addresses like “35hyUziNW5eFj2GYNpA9gf4GJrPDrrgNQL” (which is a real Bitcoin public key wallet address). You can see how the idea of anonymity springs from this—it would be hard to identify an individual based on a string of letters or numbers like that.

The idea of a ” Pseudonymous,” or tracked blockchain, comes from the fact that every transaction is recorded in the entirety of the blockchain and can be examined by anyone. In other words, it is publicly available information. Moreover, it’s challenging to acquire cryptocurrency without providing some proof of identity these days, so in theory, every transaction can be traced back to an origin where fiat currency of one kind of another was exchanged for crypto. Though, in theory, every transaction on the blockchain is anonymous, regulations put in place by exchanges and other sources for acquiring cryptocurrency make that anonymity questionable at best.

Is Blockchain the future? Different Types of Blockchains for Different Uses

Lastly, let’s look at the different types of blockchains. There are three main types: public, private, and federated. The public blockchain is the type we’ve been discussing so far; it’s the blockchain that runs the Bitcoin network, among other things. No single entity is in charge of this blockchain. It’s decentralized, and anyone can read, write to, or audit the blockchain.

Private blockchains are run by individuals or organizations. With these types of blockchains, a central authority must grant permission to those who wish to read, write, or audit; access is selective and determined on a case-by-case basis. These types of blockchains are used when the cryptographic security of a blockchain scheme is desired, but the transactions or data stored in the blockchain are not subject to public scrutiny, which may be useful for a private organization or corporation.

Lastly, there’s the federated—also called consortium—blockchain. These are similar to private blockchains, but there is more than one central authority that can grant permissions. These involve a group of organizations or individuals who collaborate to make decisions on what kind of transactions are allowed to be created on the blockchain, and by whom. This type of blockchain would theoretically be useful for something like a collection of financial institutions who want to set specific guidelines regarding the validity or verification of each transaction as it gets added to the ledger. In this way, each transaction would have to be approved by a set number of federation members before being added to the blockchain.

These three types of blockchains lend themselves to different applications—public, private, and on a larger corporate or organizational level. Moreover, these blockchains are being used in increasingly inventive ways—not just to track the flow of cryptocurrency, but in applications like “smart contracts,” which don’t require any third-party to monitor or legalize the contract.

The application of blockchain data is useful for countless things, most notably secure and incorruptible data backup, the protection of intellectual property rights, medical records stored as data in blockchain format, the inventory and tracking of prescription drugs, encrypted messaging, and decentralization of many kinds—from stock markets to social networks.

The blockchain, though not a new idea, is a computing concept with a limitless number of possible applications and represents nothing short of a revolution in data storage, retrieval, and security. It’s a technology that will continue to see increased use and application, both in public, private, and federated forms, across a wide array of industries and services. It is the future—and the future is now.

Be sure to check out our other articles & videos on our website!

Looking for the best cryptocurrency wallet to easily store your cryptos, track your portfolio, or stay up to date with the market and news? Make sure you check out the Monarch Wallet here: https://monarchwallet.com/. You can download on iOS or Android, Windows or Mac Os.