Top Blockchain, Bitcoin And Cryptocurrency Books For Beginners Or Those Who Want To Learn More!

Top Blockchain, Bitcoin And Cryptocurrency Books For Beginners Or Those Who Want To Learn More!

Want to learn more about the bitcoin, blockchain, and cryptocurrency, but not sure where to begin? While the Internet is usually a great place to start extensive research, it can sometimes be difficult to sieve through all the information in search of what is useful, valuable, and even accurate. In this article, we have compiled 25 books all about blockchain and cryptocurrency, all of which contain information beginners should understand and appreciate. Read on to learn more.

***Please note, this list and review of books is not a recommendation to buy, sell, or invest and is not to be misconstrued as financial advice. Always seek professional financial and legal advice from certified professionals before investing in anything.

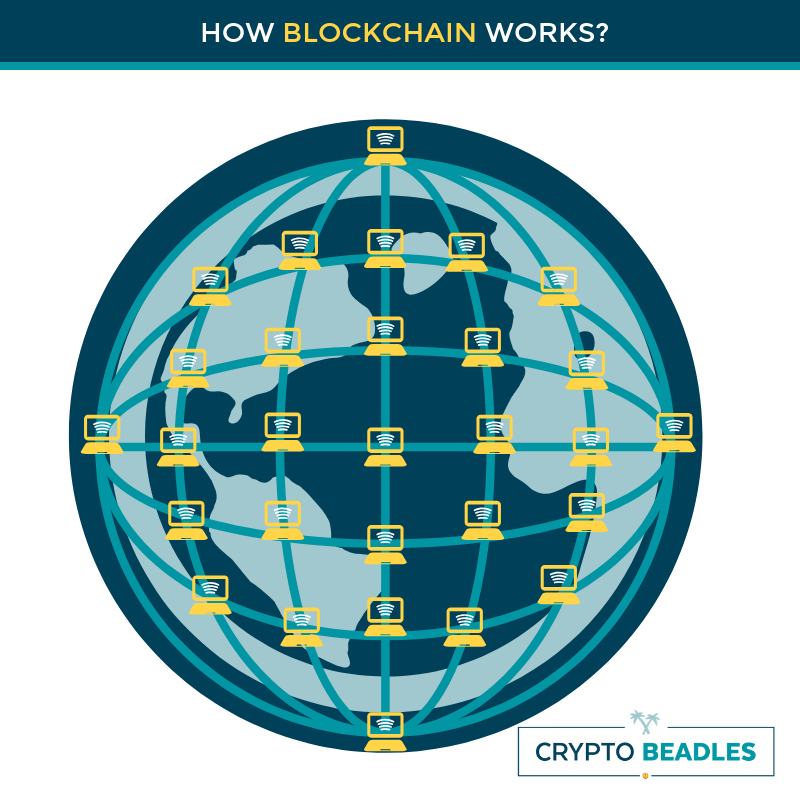

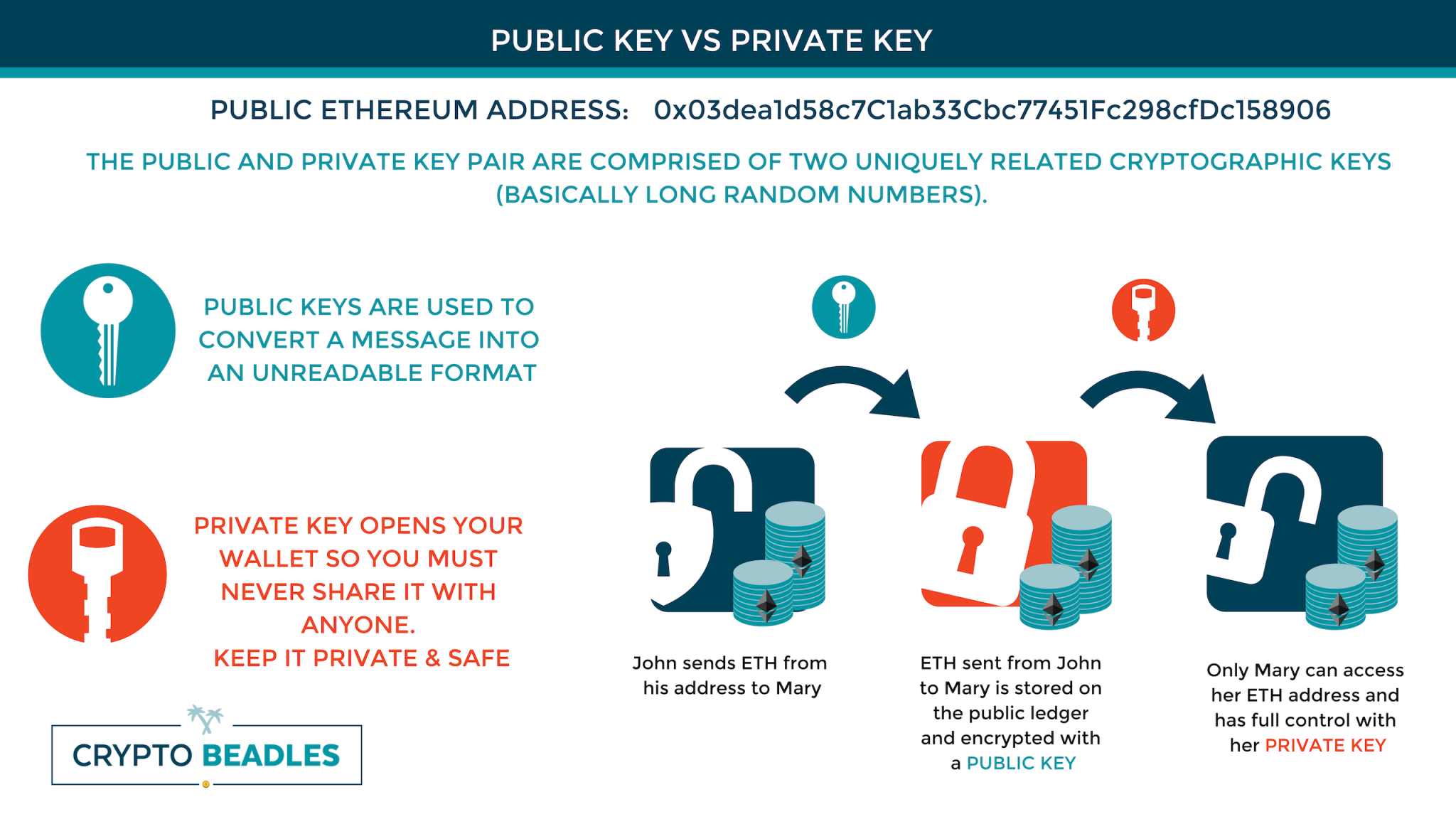

This is an accessible guide to Bitcoin, blockchains, and cryptocurrency and is aimed at the reader with little to no background on the subject. Lewis covers the history and basic background of blockchain technology and cryptocurrency, including Bitcoin, Ethereum, and other cryptocurrencies. Readers can gain a good general understanding of Bitcoin basics, including how the blockchain works, what it is used for, how payments are made and how transactions on the blockchain network are kept secure and “hack-proof.”

The author also delves into the subject of buying and selling Bitcoin, as well as the process of mining it. He covers these topics in an accessible way, especially for a general audience who may not know the first thing about the technology behind Bitcoin. Other cryptocurrencies are examined and explained, and some time is spent on the subject of cryptocurrency pricing and how relative values are typically assigned to “virtual currency.”

#2. Blockchain: The Next Everything By Stephen P. Williams

This introduction to blockchain technology and everything it makes possible is engaging, well-written, and easy to understand, even for readers who don’t have a highly technical background. Williams tackles the subject of the blockchain by examining how cryptocurrencies like Bitcoin are in essence the tip of the iceberg when it comes to what this technology can and—in the view of Williams and many others—will deliver.

He manages to explain the subject in a straightforward and accessible way, using apt metaphors to bring understanding to a general audience and does an admirable job of illustrating why this unhackable technology and its decentralized system of operation may revolutionize banking, business, and eventually many aspects of our everyday lives. He also dives into how blockchain technology represents a genuinely revolutionary and potentially life-changing paradigm shift once it sees widespread use, which Williams depicts as all but inevitable.

#3. The Internet of Money by Andreas M. Antonopoulos

Antonopoulos, is a well-known information-security expert who has written other titles on the subject of Bitcoin, presents a collection of essays that deal less with explaining the technical ins and outs of Bitcoin and the blockchain, but rather takes an informative and nuanced look at the significance of the cryptocurrency that changed everything and the revolutionizing power of the technology behind it.

Antonopoulos presents an intriguing view of a world where Bitcoin brings transformative and disruptive power to financial systems which have grown antiquated in their function and their influence. He makes the case that Bitcoin represents less a novel currency that exists in the decentralized and democratized blockchain, but in actuality is a harbinger of sweeping social change and transformation.

Andreas writes that Bitcoin represents an evolution in economic systems that will fundamentally change the way the concept of currency is thought of and utilized, and this “internet of money” will bring sweeping social and political changes, altering the international landscape of trade and finance in bold, progressive, and liberating ways.

#4. The Unified Wallet: Unlocking the Digital Golden Age by Kyle Kemper

Kemper presents a speculative vision of a world a few years from now, when cryptocurrencies will have matured to a point where a unified digital wallet will represent a revolution in personal freedom, allowing the individual not only to access trade and commerce on a global scale—with no need to exchange currencies or worry about exchange rates. It will also pave the way to revolutionize the way the private citizen navigates political and private institutions.

Kemper makes a case for a mature adoption of blockchain technology leading to sweeping changes in how we store, retrieve, and access everything from financial exchanges to legally binding contractual agreements and even personal medical records. With a solid grounding in the potential of these technologies as they exist today, Kemper illustrates one way the key elements could be drawn together to form the basis for a digital revolution in not only commerce but information technology as we know it.

Perhaps a bit sensationalist in scope and tone, The Crypto Crash Course nonetheless succeeds in providing a solid grounding in the blockchain technology that made Bitcoin and other cryptocurrencies possible. Richmond goes on to discuss many of the other “altcoins” in the cryptocurrency world and suggests methods to capitalize on investing in not only Bitcoin but some of the lesser-known cryptocurrencies as well.

Richmond ties the financial collapse of 2008 to the birth of Bitcoin and sees blockchain technology as a liberating force capable of changing the way commerce is conducted. Presenting solid arguments for how the existing financial system was fundamentally changed by blockchain and what Richmond calls “the cryptocurrency revolution,” he goes on to detail the meteoric rise in popularity of cryptocurrency and moves on to focus on the financial opportunities the emerging cryptocurrency markets represent.

#6. Ultimate Blockchain Technology: Mega Edition by Lee Sebastian

Marketed as a six-book series, the combined page count of this “Mega Edition” is 378 pages, making each individual book a little on the slim side. Originally published on Amazon’s Kindle platform, these books represent a decent, non-technical introduction to the concepts behind the blockchain and Bitcoin.

Sebastian does a good job of providing technical information in a manner that’s accessible to most readers, and the six separate volumes cover everything from the basics of understanding the concepts behind the blockchain to how its distributed ledger technology is used in the buying and selling of crypto—or cryptocurrencies—in general. The later volumes of this book series detail Bitcoin investment strategies and the basics of Bitcoin mining—a highly technical undertaking that few may want to engage in. Still, an informative (if quick) read.

#7. The Bitcoin Standard: The Decentralized Alternative to Central Banking by Saifedean Ammous

In this book, Ammous takes an extensive view of Bitcoin, analyzing its historical importance and the factors that led up to its creation, the various economic properties which gave it its meteoric rise, and continues with a speculative look at the long-term implications not just economically, but socially and politically as well. Perhaps most interesting is the connection drawn between monetary collapse—which Bitcoin could be argued to be a symptom and a harbinger of—and the historical collapse of civilizations which seem to coincide with the failure of existing currency systems.

Ammous does an admirable job of explaining both how Bitcoin functions and the technological underpinnings of this revolutionary new form of currency, and proceeds to provide intriguing and wide-ranging speculation on Bitcoin’s likely impact on world governments and how they may already be losing control of currency—bringing about an apolitical, international economic reality where the individual has control over how and where to engage in commerce, unfettered by centralized banking authorities or governments.

#8. Beyond Blockchain: The Death of the Dollar and the Rise of Digital Currency by Erik Townsend

Townsend, formerly a distributed systems architect and an expert in the nascent technologies involved in the creation of the blockchain and its subsequent use to facilitate cryptocurrency, subsequently worked as a hedge fund manager, where he gained extensive insight into the ins and outs of reserve currency.

As such, this makes him perhaps uniquely qualified to write a book with such a provocative title, and he shares his expertise on both conventional and virtual currency and how the latter may well pave the way for the eventual obsolescence of the former. Most compelling is Townsend’s suggestion that the “death of the dollar” may not come at the hands of apolitical cryptocurrency adopters embracing the democratization of a decentralized economic system, but rather by foreign governments—namely Russian and Chinese—intent on eliminating the US dollar’s dominance on the world economic stage.

#9. Unblocked: How Blockchains will Change Your Business (and What to do About it), by Alison McCauley

Here, McCauley focuses on the blockchain and the revolutionary changes this technology promises to bring with it as it gains ever more mainstream acceptance and relevance. Comparing blockchain technology to no less transformative technologies than social media, mobile computing, and even the birth of the internet itself, she makes the case that blockchain technologies will invariably and inevitably alter the structure and functioning of conventional industries and business models, while simultaneously bringing sweeping changes to every aspect of private and public life.

Practical and measured in scope and content, Unblocked illustrates with admirable clarity what blockchains are and how they present novel and far-reaching opportunities for change. What’s more, McCauley illustrates strategies that informed parties can use to harness the power of this growing phenomenon and use it as a force to empower—not obviate or disrupt—the function of existing organizations in a world soon to be transformed by this pervasive technological advance.

Vela presents a compendium of facts about blockchain intended for a general audience in a way that’s both accessible and concise. He examines the fundamental history of blockchain technology and provides an easy-to-understand grounding in the basic design and functionality of the blockchain. Building on basic definitions and concepts central to understanding the blockchain, Vela covers issues like how the integrity of the blockchain is maintained and verified, how the fundamental trust of blockchain accounting functions, and goes on to present blockchain technology as a revolutionary force capable of bringing about unprecedented change.

He examines both the numerous benefits of blockchain technology as well as some of what he sees are possible downsides or disadvantages, expounds on the likely effect of blockchain technology on the future of global financial markets, and rounds out the book by clearing up some “myths and misconceptions” of the nascent technological powerhouse.

Rose writes about Bitcoin and other cryptocurrencies primarily from an investor’s point of view, touting the many advantages of the various forms of cryptocurrency and likening them to “the next internet” in terms of their capacity to enact sweeping changes in commerce, investing, and other aspects of finance.

Underscoring the decentralized and stateless nature of cryptocurrency, Rose highlights the challenges traditional financial institutions, and perhaps even governments may face with the rise of cryptocurrency. It is marketed as a “practical guide,” and it’s not an unfair evaluation, as the author presents all the information a cryptocurrency novice would need to begin investing—or at least to make their first purchase—in crypto. With guides on how to join a cryptocurrency exchange, it’s a good read for those who are interested in cryptocurrency primarily as a potential investment opportunity.

#12. The Layman’s Guide to Bitcoin: What it is, How it Works, and Why it Matters by Logan Brutsche

This Kindle-only eBook is a quick read, and while geared toward a non-expert audience, does a thorough job of explaining the intricacies of Bitcoin and blockchain in a manner that’s both accessible and complete. Making good use of illustrations and examples, Brutsche guides the reader through a solid understanding of the key concepts and works his way up to a comprehensive overview of more advanced concepts and trending developments.

The book aims to provide a grounding in the core concepts of Bitcoin and other cryptocurrencies and does a good job of that. While not providing exhaustive information on the subject or going into the intricacies of related technology like blockchain, by the end of this eBook, readers will be conversant on the subject of cryptocurrencies as a whole. A great starting point for those interested in the subject.

This book presents blockchain as a sort of conquering liberator, bringing its “disruptive” power to centralized digital networks and presenting a wildly democratizing force that is, as many other books and authors have said, the most innovative and revolutionary technological advance since the birth of the internet.

The book explains blockchain from the technology that powers it to its use in practical applications, its intersection with Bitcoin, and expounds from there on the various advantages blockchain technology provides. It sketches out current and likely future scenarios of how businesses will use blockchain in all manner of applications. With an almost evangelical zeal, the author posits that blockchain promises to put an end to corruption and the centralized institutions that enable it, ushering in a new era of openness, individual empowerment, and honesty.

Caro presents this work (originally a three-volume set on Amazon’s Kindle platform) as less of a technical guide and more of a practical introduction to the concepts behind cryptocurrency technology. Intended for a non-technical audience, the book examines the history of blockchain technology and its use in managing and safekeeping digital transactions, a basic roadmap regarding ways that businesses and individuals may potentially profit from adopting blockchain, and continues onto the subject of Bitcoin and the Ethereum cryptocurrency.

The author’s look at Bitcoin and other cryptocurrencies is as practical as the first part of the book, and he again offers some strategies that one might use to buy, safely store, and trade Bitcoin and Ethereum, ultimately with an eye toward making a profit in these emerging virtual markets. Presenting cryptocurrencies, powered by the blockchain, as nothing less than a financial revolution in the offing, Caro provides a solid and enthusiastic grounding in the subject while not delving too deeply into the technological basis behind them.

#15. The Book Of Satoshi: The Collected Writings of Bitcoin Creator Satoshi Nakamoto by Phil Champagne

Satoshi Nakamoto is the pseudonym adopted by the creator—or creators—of Bitcoin, and the person or people behind it have been cloaked in shadowy details and internet myth since the inception of the original cryptocurrency. Champagne presents Satoshi Nakamoto as roughly equivalent to the currency created under that name: existing only virtually, a primarily online entity who cannot be interacted with in an analog world.

In an effort to present a more complete picture of the thinking or motivation behind the Nakamoto persona, Champagne catalogs and presents the “essential writings” as they appeared under the Nakamoto name in emails and posts on computer forums. Sticking to chronological order, the material allows for a great understanding of Bitcoin and its fundamentals, as well as giving the perceptive reader some insight into the motivations behind the Nakamoto enigma.

#16. The Blockchain and the New Architecture of Trust by Kevin Werbach

An Associate Professor of Legal Studies and Business Ethics at Wharton, Kevin Werbach offers an original and interesting take on many of the intricacies involved with the blockchain. He presents his analysis of blockchain and what he sees as its true potential, as well as some of the potential dangers and drawbacks inherent in the technology. He meticulously explains how blockchain works, which he presents as a technology “resting on foundations of mutual mistrust.”

Werbach details the emergence of the blockchain, its intersection with Bitcoin, and how (despite early adoption by money launderers and the international drug trade) the technology behind blockchain has been the genesis of hundreds of new companies, the destination of billions of dollars of speculative investment, and has now been embraced by financial institutions and corporate organizations worldwide.

Malekan sets out to explain blockchain technology for the layman by using a series of anecdotes that mesh metaphorically with the intricate complexities inherent in the underlying framework that makes the blockchain run. Presenting blockchain technology as one of the most innovative and promising technological advances in recent memory, Malekan seeks to demystify the subject by making it relatable, accessible, and plainly understandable.

The author starts with the origins of the blockchain and explains why—and how—it was created in the beginning. The book progresses by explaining how it’s being used today, and how it has a good chance of eventually impacting everything about the way our technological world works. Each chapter covers a particular aspect, but the book flows together well and presents an easy-to-follow narrative that will leave the reader with both a greater innate understanding of this revolutionary technology and the necessary knowledge—and likely motivation—to get involved in it firsthand.

#18. The Blockchain Revolution: How Cryptocurrency Is Shaping The New Digital Economy by Branden M. Griffith

This book, while not focused solely on investing or trading in Bitcoin and other cryptocurrencies, culminates with information many interested in the subject may be looking for, while also providing a solid basis in the technologies that underlie the cryptocurrency revolution and make these new monetary platforms possible. He doesn’t focus solely on Bitcoin, but delves into other cryptocurrencies like Litecoin, Ethereum, and the Neo platform.

Griffith presents blockchain technology as something that is still widely underrated in terms of its value to investors and compares it to earlier technologies that didn’t see widespread use or engagement until they were clearly game-changers in their specific niches. Intended to be a comprehensive guide to understanding blockchain and its impact on the future of the economy, the book does a good job of covering blockchain’s historical development and places some bets on where the future of the technology is likely to lead and provides a solid grounding necessary for anyone considering getting more involved with cryptocurrency.

#19. Cryptocurrency FOMO: How to get into Bitcoin without really caring what Bitcoin is by Derek Parnett

Intended for people interested in delving into Bitcoin, but who may not want or need to understand the intricacies of the blockchain and the importance and promise of the technology that makes cryptocurrencies possible, this book is written for those who want to quickly—but as safely as possible—dive into Bitcoin. It’s geared toward an audience that doesn’t particularly care about the technological framework behind the most revolutionary new type of currency to perhaps ever exist, but who sees its value and its potential for widespread use and potential profitability.

Parnett covers the basic facts needed before purchasing Bitcoin, the various processes involved in actually acquiring the cryptocurrency—including a step-by-step guide on how to set up and fund accounts on Bitcoin exchanges—and even goes into the steps necessary to purchase other alternative cryptocurrencies.

#20: The Age of Cryptocurrency: How Bitcoin and the Blockchain Are Challenging the Global Economic Order by Paul Vigna and Michael J. Casey

Journalists who cover Wall Street and the global economy, Vigna and Casey take an in-depth look at Bitcoin, its relevance, its history, and its likely international impact. Taking the stance that Bitcoin and other “cybermoney,” as they refer to cryptocurrency, is poised to revolutionize traditional financial and social norms, they make a strong case as to its relevance to everyone—not just the techno-elite. They go into one of perhaps the most overlooked aspects of cryptocurrency: it’s ability to provide access to the global economy to millions of currently “unbanked” people the world over.

It’s not all wine and roses, in their view—Bitcoin has in the past suffered wild fluctuations, marked instability, and has been tied to money laundering and the international drug trade. Though those days may largely be behind the cryptocurrency, it still promises to be a disruptive technology, with the potential to eliminate thousands of jobs as well as, as Vigna and Casey state, alter the relevancy and the function of governments worldwide.

#21: Cryptoconomy: Bitcoins, Blockchains & Bad Guys by Gary Miliefsky

Miliefsky looks into the dark side of Bitcoin and some of the scams, thefts, and other criminal activities tied to the innovative cryptocurrency in this title. Making the compelling argument that would-be investors need to educate themselves on the various complexities of the “crypto-economy” before diving in with the intent to invest, Miliefsky details the various risks involved in a clear and engaging manner.

Miliefsky examines the Foreign Exchange (or FOREX) and its relation to cryptocurrency trading, and details some of the shadier developments in Bitcoin’s recent history, including its growing currency of choice among hackers and ransomware developers who demand payment in the tens of thousands of dollars—via Bitcoin—in order to undo damage or restore data to its rightful owners—or who, in some cases, have managed to steal hundreds of thousands of dollars of Bitcoin from improperly secured digital exchanges.

Wenker examines the complexities of a global currency like Bitcoin that—by its very nature—is decentralized and lacks clear regulatory control. While many point to that decentralized, democratized aspect of the cryptocurrency as one of its greatest strengths, Wenker points out that world governments are keen to control its trade and use, and are continuously seeking ways to implement controls on the otherwise anarchically traded cryptocurrency.

Wenker has done his homework. The book references hundreds of sources, from research reports to legal cases, and presents a complex panoramic view of Bitcoin and its impact thus far on global commerce. Covering not only the economic effect, but also the implications for technological changes and its likely impact on the way business will be done in the future, Wenker explores the almost frantic pace at which various international governments have (perhaps too late) attempted to limit or contain the use and influence of Bitcoin and other cryptocurrencies.

Wolfe presents a picture of blockchain technology as the most significant technological innovation since the advent of the internet and makes the compelling case that it will soon become ubiquitous and global in its impact and influence. Forwarding well-developed claims that blockchain technology will change the way governments, banking institutions, the health industry, and business organizations operate and interact on a day-to-day basis, Wolfe paints blockchain as a multi-purpose tool with the ability to impact the lives of everyone on the planet.

#24: The Bitcoin Manifesto Paperback by Allan J Stevo

Presented as a “call to action,” this title aims to present a serious dialog about the future of Bitcoin, its strengths and weaknesses. The book also looks to dispel what maybe myths or outright lies about the nature and impact of the Cryptocurrency.

Stevo is a founding member of the New York Bitcoin Center and has the credentials to back up his claims. He may well be one of the most knowledgeable sources on the subject, and the picture he paints of Bitcoin and its potential as a revolutionary way to do business is both balanced and reasonable.

Kinsey writes about the history of the blockchain, how the technology works and some of the uses it can be put to, as well as going into the background of the group that created it—and their motivations. Written so that a non-technical audience can quickly grasp the concepts discussed, this book goes into some of the finer points of blockchain technology and its potential to be a disruptive and revolutionary tool and presents readers with information intended to help them form their own conclusions about the likely impact of this new and exciting technology.

We hope that you find these books to be informative as you begin your journey to mastering the blockchain. If you have any more questions, Be sure to connect with us on our Telegram Community Channel today.