How To Store Cryptocurrency / Safeguard Your Crypto Assets

A few years ago, everyone was scratching their heads over the question: what on earth is a cryptocurrency? For some people, it looked like nothing but a fad, while others were hailing it as the future of finance and the end of many current monetary institutions. Right now it’s still hard to tell where cryptocurrency will be in a decade, but it seems it will be here to stay in some capacity. Not to mention, the technology that the advent of cryptocurrency has brought us, blockchain technology, has already begun to see use in other industries.

So now that we’ve accepted cryptocurrency as a part of our world, we’ve progressed to an even trickier dilemma for pondering: how to store your crypto safely.

Cryptocurrency presents a significant departure from traditional money and credit systems. Even for those early to the scene, there’s still some uncertainty about the storage and exchange of cryptocurrency. We’re seeing many different storage methods emerge, but none has emerged as the clear winner in terms of convenience and security. Read on to learn more.

The main cryptocurrencies

Before we dive into the options for storing cryptocurrency, let’s run down the basics of what it is. Cryptocurrency is a digital form of decentralized currency that relies on encryption methods to regulate its quantities and availability. While most everyone has heard of bitcoin, it’s not the only kind of cryptocurrency out there. In fact, there are well over a thousand crypto options right now.

Comparatively, the United Nations recognizes fewer than 200 kinds of traditional currency. If you’re new to the crypto game, then you’ll likely be dealing with one of the following well-known cryptocurrencies:

- Bitcoin

- Ethereum

- ERC-20 tokens

Each currency presents its own unique challenges or advantages and operates at different exchange rates. It’s all a lot to take in. On top of it all, you have to worry about how you’ll be storing your cryptocurrency. Moreover, it’s, unfortunately, a bit more complicated than filling out a deposit slip at your preferred bank. Safely storing cryptocurrency is younger than most middle schoolers, and there’s not much public trust in the system yet, so you’ll want to tread carefully.

How to protect your crypto

So how do you go about storing cryptocurrency? You can’t just waltz into your local credit union and ask them to watch out for your bitcoins. There are a lot of different storage methods for cryptocurrency, and as a society, we’re still in the process of sorting out which practices are sustainable, practical, and safe. Here are the four basic methods to secure your crypto.

- Online wallet a.k.a. (Hot Wallet)

- Offline methods a.k.a. (Cold Wallet) – (PC/Mobile, removable hard drive, paper)

- Specialty hardware

- Exchange

No method is perfect, or we’d be able to answer the initial storage question with one sentence. Instead, what we have is a list of options, each with advantages and disadvantages. Let’s break them down one at a time.

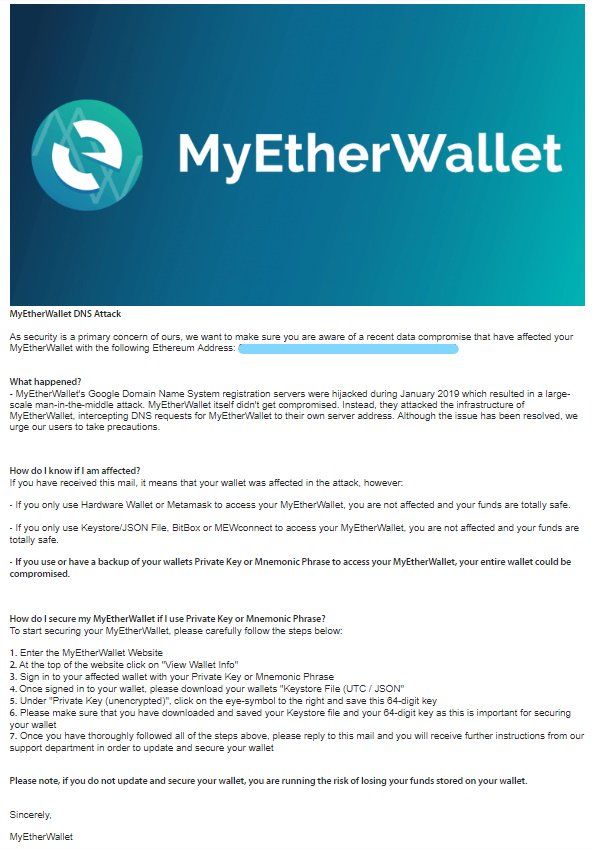

Online wallets

Storing your cryptocurrency online in any capacity is inherently risky. The online component is what puts it at a severe security risk. However, there are benefits to an online wallet that offline methods can’t provide. These benefits include:

- Easy, convenient access

- Two-factor authentication

- High-level technical knowledge is not usually required

- Easy to navigate and manage crypto

- Passwords can be reset

However, online storage has some potentially serious drawbacks, as well. Maintaining an online wallet means trusting your currency to a third party — and you ultimately have little or no control over how that third party operates. There is little to nothing stopping them from packing up shop and leaving you without a storage method anymore.

There is also little to no regulation surrounding online cryptocurrency wallets. So if something does go awry, you as a customer will be left with few resources to help you regain lost funds or seek compensation.

Offline storage

The easy solution to the risks of online wallets is to store your cryptocurrency offline. There are three basic options here: removable storage devices, non-removable storage devices, or good old-fashioned paper.

- Removable storage

Removable hard drives or USB sticks can be a safe way to store cryptocurrency. Depending on your situation, the transferring of so much data can be a hassle, but the storage device can be safely placed in a bank box or other secure location.

The other downside is the cumbersome process of transferring or using the currency. Different currencies may be easier or more challenging to put on a storage device.

- Non-removable storage

You can also achieve much the same effect by storing your crypto locally on your PC, laptop or mobile device in a Decentralized Wallet. Of course, this will be less secure if your computer then remains connected to the internet. While less likely than a hack against exchange or online wallet, someone could still break into your cryptocurrency stores if you choose to keep your currency on an internal hard drive which remains connected to the internet. However, if you have a Decentralized Wallet installed on a Mobile device with the SIM card removed and only enable WiFi when you want to send/receive, then you increase your security drastically.

- Paper

Another generally safe way to store cryptocurrency is with a printout of the private and public keys to your crypto. This is also the most arduous way of storing cryptocurrency. The major downside to paper storage is that you will need to rely on third party software to create the printable code. Not to mention, if someone sees your printout, you would be in serious trouble, as only the private key would be necessary for theft.

Specialty hardware

Here’s what used to be the crown jewel of cryptocurrency storage. Specialty crypto wallets can be purchased to store your crypto assets. Specialty hardware is more convenient than removable storage devices or paper, and it offers even more protection. For example, a poorly timed fall with a glass of water could put your paper-stored crypto at risk, but specialty hardware is a little more durable, much more convenient, and usually just as secure. These devices will come with built-in encryption and maybe one of the most reliable options out there.

On the flip side, specialty hardware comes with quite a price tag. If you’re not prepared for a significant upfront investment, then this may not be the right option for you. Companies or people dealing with large quantities of cryptocurrency may benefit from specialty hardware. However, for those who are just testing the waters, it may not be worth the money. Specialty hardware is also not available worldwide, and sometimes further backups are required for the sake of redundancy options.

Exchanges

Exchanges can seem like a desirable option to those looking to safely store their cryptocurrency, as they provide a fast and easy way to transfer crypto. This convenience draws in many users. If you’re looking to convert fiat money into cryptocurrency or trade between types of cryptocurrencies, exchanges are built for that very purpose. There are other advantages to exchanges, as well:

- No lost access due to forgotten passwords or seeds

- Ability to store multiple types of cryptocurrency

- Two-factor authentication

- Easy to set up, with little tech knowledge required

- Many accessible altcoins.

- Low transfer fees

However, even with these numerous benefits, exchanges have proven to be untrustworthy in the past. There have been multiple scandals across the globe, usually centering on cryptocurrency being stolen or otherwise disappearing, often from within the exchange itself. If a chain of banks had a history of customers losing their life savings to corrupt bank employees, you’d probably think twice before trusting them with your money. Moreover, it can be the same situation here.

Just last year, the cryptocurrency exchange Coinsecure, based in India, lost 3.5 million dollars worth of cryptocurrency. The exchange blamed the missing money on their chief security officer, accusing Amitabh Saxena of running off with the money. Whether this is true or not is uncorroborated, but it does not bode well for the exchange system that a CSO could conceivably abscond with so much money. Coinsecure will have to reimburse customers from their own funds, a promise that can still be very discomforting. After all, if a company is unable to pay people back for stolen money, there are few other resources at customers’ disposal.

As startling as the Coinsecure case was, it’s far from the most substantial amount of cryptocurrency to go missing. In January of 2018, a Japanese cryptocurrency exchange lost over 500 million dollars in cryptocurrency to a hack. The company was holding the currency in something known as “hot” storage, where the crypto is stored using an online system. This may have contributed to the ease with which the money was stolen, and many other exchanges use “cold” or offline storage. Even exchanges usually place some funds into cold storage for security reasons, but in order to provide the easy transfers, hot storage is necessary.

Moreover, it would be remiss not to mention Mt. Gox, which, despite being the most successful and well-established Bitcoin exchange, ultimately had to declare bankruptcy following the realization that close to a million Bitcoins had gone missing over a period of time. The next news cycle was not kind to cryptocurrency at large and further scared many people away from the topic. The missing Bitcoins were worth approximately half a billion dollars in 2014 when the news broke. Half a decade later, the man at the center of the embezzlement allegations is primed to receive a verdict from a Tokyo court.

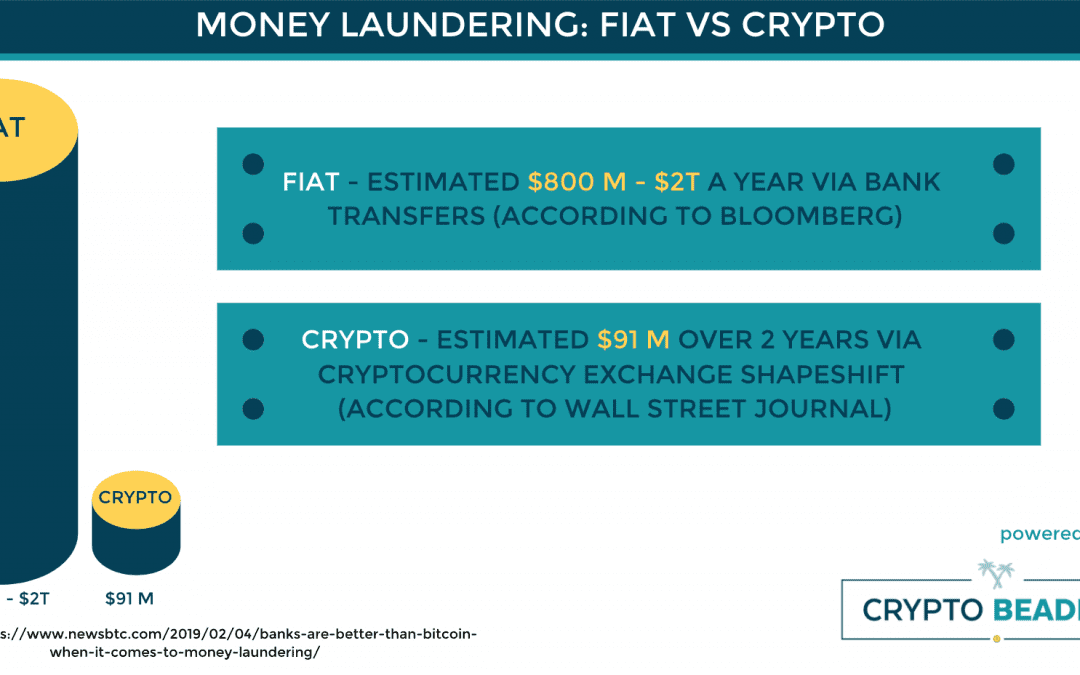

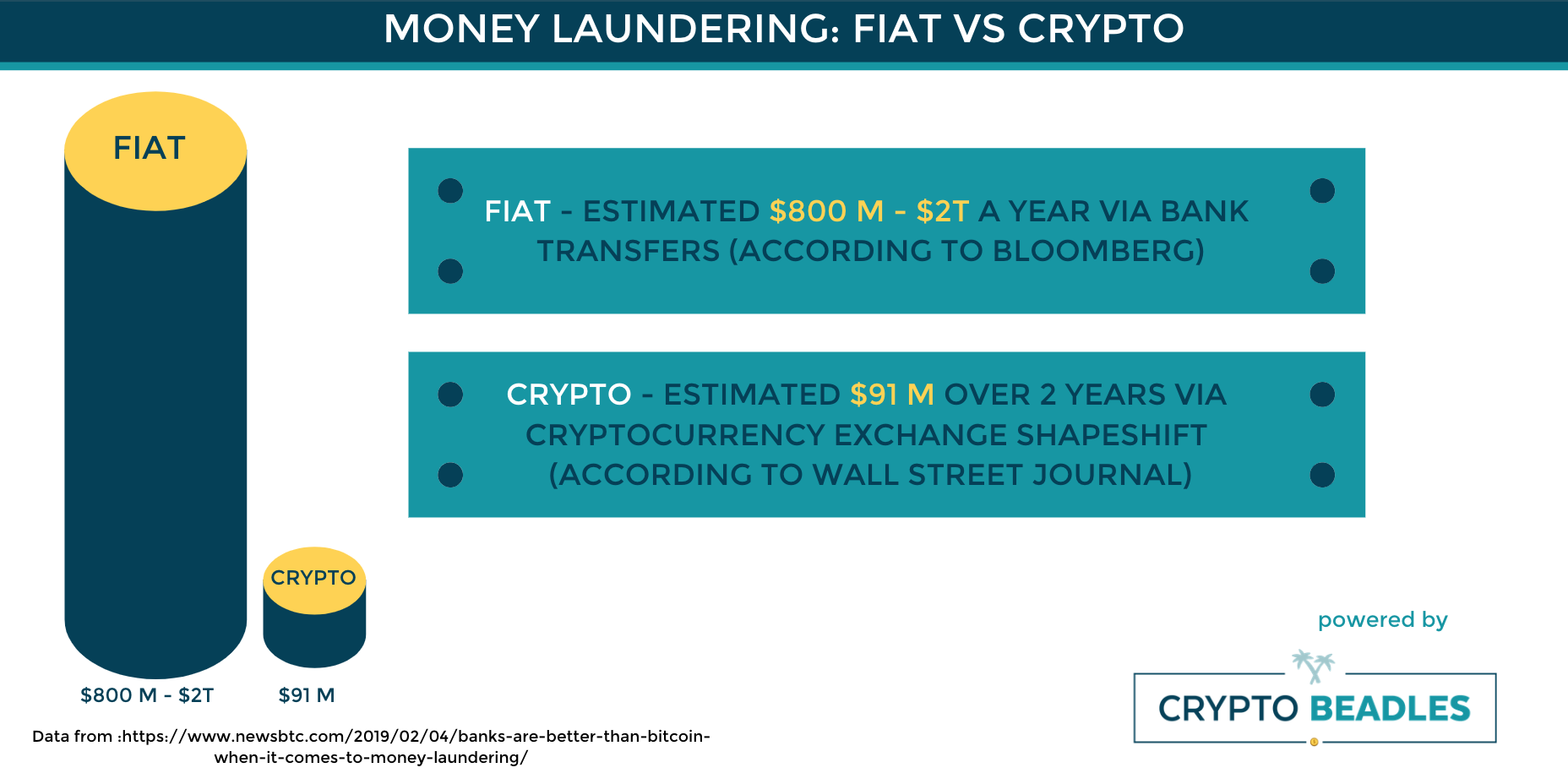

Cryptocurrency is often regarded with some suspicion by the world at large. Many law enforcement officials see it as the currency of internet criminals, and we are far from a world where cryptocurrency is largely used and accepted. This mistrust can lead to situations where governments regard crypto with less care than they may otherwise treat consumer property.

Do you remember when Alexander Vinnik was accused of laundering money through the cryptocurrency exchange BTC-E? Well, during that whole fiasco, the FBI seized the entire site, effectively preventing people from accessing their money. Because your money is considered “part of the exchange,” you are vulnerable to these kinds of instances, regardless of whether or not you are involved in the criminal activity.

Exchanges are a great option in theory, but they have not proven to be a reliable means of crypto storage yet. Perhaps in the future, we’ll see an exchange option that is proven to be safe, effective, and easy to use. Until then, however, it is wisest for most people to avoid exchanges and instead opt for different storage methods.

Make an informed decision

There are many ways to store cryptocurrency, just as there are many different banks and credit unions for your traditional money. Ultimately it is up to each person to decide how and where to store their savings. Nothing is perfect, and there can never be any guarantee that you will be exempt from potential losses with any kind of currency. The world is a fast-paced and ever-changing place, where nothing can be completely assured. So at the end of the day, the decision of how to store and protect your assets is up to you.

Hopefully, this information will help you make an informed decision about your digital assets & cryptocurrency. Also, don’t forget to take into account your circumstances. How much crypto you deal with and how essential it is to your life or business matters a lot in which method of storage or exchange you choose. The only way to truly protect yourself is to know your options and make the decision that’s best for you.

CryptoBeadles Recommendation

Robert Beadles is an avid cryptocurrency believer, and this subject is near and dear to his heart as he has watched as many people have made mistakes over the years, and some have suffered much because of their decisions. Robert recommends most people who want to safely store their cryptocurrency to download the Monarch Wallet on a mobile device that doesn’t have a SIM card, which you can connect to the internet via WiFi when you want to make transfers. The mobile device should have the built-in Phone software six digit Pin, the Pin from the Wallet, as well as you can control what software is installed on the device, as well as when the device connects to the internet helping to ensure the maximum amount of security for your cryptocurrencies.